According to the GDP report released today, James Smith, the Research Director at the Resolution Foundation, provides an explanation.

The economy of the UK has once again experienced a period of little or no growth in the past few months, largely due to a sharp increase in interest rates since the end of 2021. There is a significant possibility that the UK may enter a recession for the fourth time in the last 15 years.

Britain has been facing economic stagnation since the financial crisis and must address this issue as a top priority in the upcoming Autumn Statement by the Chancellor, which is only 10 days away.

The United Kingdom has been labeled as a country experiencing slow economic growth, known as a “stagnation nation,” due to its lack of growth during the summer months.

According to the most recent GDP data, the economy remained stagnant during the three-month period ending in September, with a slight decline in the leading services industry.

The announcement was made by ONS’s director of economic statistics, Darren Morgan, who stated:

”

The economy is believed to have experienced zero growth in the third quarter.

The service industry experienced a slight decline due to decreases in the health, management consulting, and commercial property rental sectors.

”

“However, there was some growth in engineering, car sales, and machinery leasing that helped to balance out these losses.”

During September, there was a small growth in the economy, driven by growth in the film production, health, and education sectors.

“The increase was somewhat counteracted by declines in retail and computer programming.”

The information was slightly more favorable than anticipated, however it emphasizes the negative impact that elevated interest rates are having on economic growth.

This suggests that the UK lagged behind the US and France, but had slightly better performance than Germany and the larger eurozone.

Chancellor Jeremy Hunt said inflation was the main barrier to growth, while shadow chancellor Rachel Reeves warned that “growth is flatlining and Britain is worse off.”

This is the complete narrative:

According to Larry Elliott’s analysis:

In other news…

Today, European stock markets are declining because there are concerns that the peak of US interest rates may not have been reached yet.

The Bank of England has requested over 50 financial institutions in the City to simulate the effects of a sudden change in bond prices triggered by a significant geopolitical event as part of its initial system-wide stress test.

NatWest has renounced nearly £7.6 million in potential compensation to Alison Rose, the former CEO of the banking group, who was compelled to step down due to a controversy involving the closure of Nigel Farage’s bank accounts.

The Guinness to Johnnie Walker drinks maker Diageo has issued a profit warning as a result of cash-strapped customers in Latin America and the Caribbean consuming less alcohol and seeking cheaper brands.

This year, the RAC reported that there was a significant increase in the number of vehicle breakdowns due to the poor condition of Britain’s roads, which are filled with potholes.

The US branch of the Industrial and Commercial Bank of China experienced a ransomware attack on Thursday, causing disruptions in the US Treasury market. This is just one of the many victims targeted by hackers demanding ransom this year.

Trade Nation, says:

During a speech yesterday evening, Jerome Powell, the Chair of the Federal Reserve, caused a stir.

The speaker declared that the Federal Reserve was uncertain if their efforts to control inflation were sufficient, allowing for the possibility of more interest rate increases. This surprised traders who had believed that the US central bank was finished raising rates. It appears that this belief was overly optimistic.

More here.

The Bank of England has requested over 50 City institutions to simulate the effects of a sudden change in bond prices due to a significant geopolitical event, as part of its initial comprehensive evaluation of the financial system’s resilience.

In the wake of the bond market and currency turmoil in September 2022, which occurred after Liz Truss’s mini-budget, there has been a request made concerning pension funds. The sudden change in bond prices and resulting interest rates, also known as yields, revealed significant dangers associated with liability-driven investing (LDI) and its impact on retirement savings.

Large financial institutions, including banks, investment firms, and insurance companies, have been requested to simulate how their activities could be impacted by an unforeseen fluctuation in bond prices. They are expected to share their findings with the central bank by January.

More here.

During the Financial Times Global Boardroom conference today, Christine Lagarde stated that if borrowing costs remain at their current levels for a sufficient amount of time, eurozone inflation will reach its target of 2%.

This does not indicate that we will see a change in the next few quarters. The time frame must be significant enough.

Observe the changes in UK inflation and economic growth.

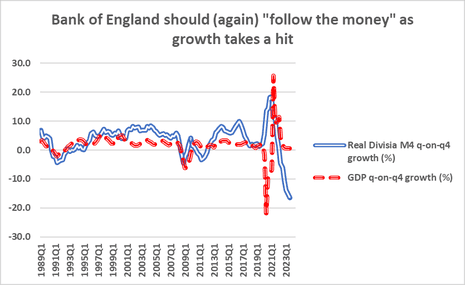

The Chart below plots real Divisia M4 (q-on-q4) growth together with real GDP (q-on-q4) growth. Real money growth affects GDP developments with long and variable lags. In fact, real money growth turned negative in mid-2022. Since then, real money has shrunk fast.

It is highly probable that the UK will experience a recession by early 2024, potentially leading to interest rate reductions occurring sooner than what the BoE’s policymakers anticipate.

The GDP report released today indicates that there was no growth in July-September.

Prieg explains:

The growth figures released today continue to paint a familiar picture: the UK is lagging behind other developed countries. Our post-pandemic recovery is one of the weakest among the G7 nations. The reason for this can be traced back to a lack of investment in the past ten years, which has resulted in our country being economically disadvantaged.

”

Our country’s energy bills are among the most expensive globally, resulting in less disposable income for consumers to spend on retail. This is due to the lack of government funding towards insulation and renewable energy sources. Our workforce is diminishing due to reduced investments in our healthcare system, resulting in more individuals being unable to work due to illness. Additionally, the lack of public funding towards eco-friendly industries and infrastructure has led to a decrease in wages for local workers.

We must make investments to improve the financial well-being of the British population. These investments include renewable energy and home insulation to decrease energy costs, funding for the NHS and schools to ensure that individuals can work while healthy and well-educated, and investments in green industries and infrastructure to stimulate economic growth and increase wages.

According to Henry Cook, a senior economist at MUFG, a Japanese bank, the overall situation is still one of inactivity, and he also mentioned that:

The economy has not experienced a recession, but there has been sluggish growth for the past six quarters.

Our initial scenario is that there will be a steady but modest increase in growth until 2024, with a possibility of a decline in at least one quarter. In general, we anticipate that the overall trend of stagnation will persist next year, with a projected annual growth of approximately 0.5% in 2024.

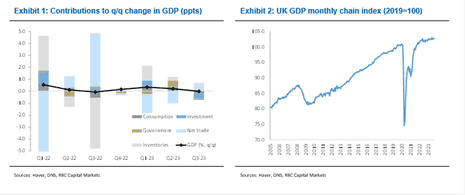

According to Cathal Kennedy, a senior UK economist at RBC Capital Markets, the reported 0% growth rate is deceiving and actually represents a significantly underperforming economy.

The primary factor driving growth in the third quarter GDP was net exports (refer to Exhibit 1). Exports increased by 0.5% quarter-on-quarter, largely due to a rise in services exports. On the other hand, imports decreased by 0.8% quarter-on-quarter, reflecting a decrease in domestic demand. Additionally, inventories saw an increase.

However, domestic performance was lackluster. Household spending decreased by 0.4% compared to the previous quarter, while investment (GFCF) dropped by 2.0% q/q. Government spending also saw a decline of 0.5% q/q. These decreases were influenced by specific circumstances; labor strikes in the healthcare and education sectors affecting government consumption, and the expiration of the super-deduction allowance at the end of March leading to a shift of business investment into Q2.

Microsoft has issued a warning that certain users from the UK and Germany may experience difficulties accessing their Microsoft 365 suite of products.

This may include digital versions of Word, PowerPoint, Excel, and OneNote.

By next summer, Alison Rose will be receiving approximately £1.75 million from NatWest, which is 12 months after she resigned.

NatWest says:

The Board has verified that, according to Ms Rose’s service agreement, she will receive payment for her fixed salary components until the end of her contractual notice period on July 26, 2024.

These contractual elements comprise salary, fixed share allowance and a pension allowance of 10% of salary and contractually agreed benefits in line with the terms of our approved Directors’ Remuneration Policy (DRP).

The sum of the remaining notice period is £1,748,142.

Source: theguardian.com