At 2:30pm, the Office for Budget Responsibility reports.

The predicted decrease in living standards, determined by calculating the amount of real household disposable income (RHDI) per person, is estimated to be 3.5% by 2024-25 compared to before the pandemic.

Although it falls short of the fiscal watchdog’s predicted decline in March, this still marks the most significant decrease in real living standards since ONS records began in the 1950s.

The OBR explains:

Individual per capita RHDI returns to pre-pandemic levels in 2027-28, a milestone we did not predict in our March forecast, due to the strength of labor incomes compared to a decrease in inflation.

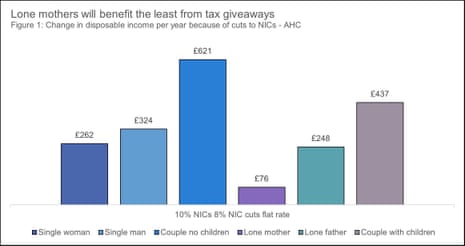

Based on our calculations, the decrease in NICs rate mentioned in the autumn statement will lead to a 0.5% increase in actual household earnings by the end of the projected period.

Torsten Bell of the Resolution Foundation expresses concern for Conservative MPs.

Jeremy Hunt plans to use the increased tax revenues resulting from higher inflation.

The head of the Office for Budget Responsibility, Richard Hughes, states that the chancellor now has more flexibility to adhere to his fiscal rule of having public sector net debt decrease at the end of the projected period. This amount has increased to £13 billion, up from £6.5 billion in March.

However, this is due in part to the fact that the target has been pushed back by one year to 2028-29.

In general, Hughes states that the state of the public finances remains largely the same as it was in March.

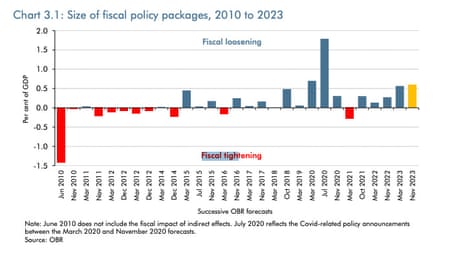

The OBR report highlights this fact.

“Fiscal loosening” refers to a measure where the Treasury reduces taxes or increases spending, essentially giving away money. On the other hand, “fiscal tightening” is when the opposite occurs.

The budget for March 2020 was announced prior to the Covid lockdown, however, it did incorporate Covid-related stimulus measures totaling £30bn.

The number of single parent households struggling with poverty has tripled since 2019. These households are at the greatest risk of being affected by the benefit cap and require access to local resources such as childcare and healthcare.

Stephenson stated that we are facing a winter that will be more challenging than the previous year.

The payments for living expenses are coming to an end, however, prices for essentials such as food, energy, and housing are still very expensive. Women are disproportionately affected by poverty and are bearing the majority of the burden during this cost of living crisis.

The Office for Budget Responsibility presents.

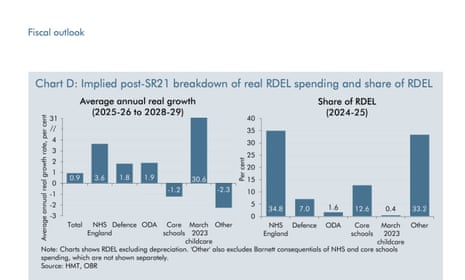

Richard Hughes, the head of the OBR, has informed journalists that Departmental Expenditure Limits (DELs) account for 40% of government expenditure.

They are scheduled at regular intervals, and the next evaluation will not occur until after the overall election.

The Treasury has informed the OBR that departmental spending will increase by £5 billion annually after 2024-25.

According to Hughes, this indicates that the actual spending power of the department has decreased by £19bn in comparison to the forecast made in March.

Currently addressing the media at a press conference, Hughes states:

You may have noticed that this number is approximately equivalent to the sum of money the chancellor allocated for the two major tax cuts during this fiscal event.

If he had attempted to maintain the actual purchasing ability of government services, despite an increase in inflation during the next five years, he would have had limited resources for implementing other actions.

According to our previous post, economists claim that the Treasury’s spending estimate is not feasible.

According to Hughes, expenditures for departments are increasing because of inflation and changes in policies such as the NHS workforce plan and the goal to increase defense spending as a percentage of GDP.

The numbers are depicted in the OBR report.

The OBR says, diplomatically, that this would “present challenges”. It says:

Reducing day-to-day spending by 2.3% in real terms would pose challenges. Public service performance indicators show signs of strain, such as the record high backlog of 65,000 cases in crown courts in August 2023 and the issuance of eleven ‘section 114s’ notices by local authorities since 2018, compared to only two in the previous 18 years. A recent report by the Institute for Government revealed that eight out of nine major public services have seen declining performance since 2010, with schools being the only exception. There are also long-term pressures on public spending from factors like climate change and an aging population.

Ian Mulheirn, an economist from the Resolution Foundation think tank, is more direct. He believes that these proposed spending plans are not feasible.

The OBR has determined that there are highly improbable consequences, such as significant reductions in funding of 2.3-4.1% per year starting in 2025 for departments without protection. This is quite astonishing.

What is the proposed course of action? Are the goals to eliminate the criminal justice system and revamp public transportation?

The focus of the discussion should be whether taxes have truly been reduced, not just if they have been cut.

The main focus of the #Autumnstatement is that there has been a £21 billion per year tax reduction, which has been supported by a £19 billion per year decrease in public services.

This is not a sustainable situation, and whoever is elected will have to increase taxes once more – and possibly even more – in order to maintain stability.

This is a statement from Daniel Tomlinson, a member of the Joseph Rowntree Foundation think tank.

The government has reduced its budget by £19bn annually in comparison to the previous estimate, despite increasing demands on public expenditures.

This is not a responsible approach to managing finances.

This information is attributed to Chris Giles of the Financial Times.

is

The main focus of the autumn statement by @OBR_UK is

Government budget is improving due to the fact that government expenses are not increasing in line with inflation.

The proposed budget estimates indicate that Hunt is not anticipating his party’s victory in the upcoming election. They also reinforce Rafael Behr’s argument in his column today that Hunt is devising a plan to ensnare Labour.

Gerald Eve, said:

The Chancellor’s actions regarding business rates are deceptive. They are intended to receive praise for safeguarding businesses from rate hikes, while also generating an additional £8 billion in revenue from rates.

“The announced freeze will benefit approximately 89% of properties, with larger businesses responsible for 75% of the rates for over 220,000 properties next year being the main target of this stealth tax.”

Jeremy Hunt announced a proposal to expedite the process of obtaining planning consents, reduce the time it takes to receive new grid connections, and provide investors with favorable tax incentives, which are among the most generous in the developed world.

The businesses, who have intentions of investing billions of pounds in the UK’s shift to green energy, are likely to reap rewards from the Treasury’s commitment to permanently implement “full expensing”. This was labeled by Hunt as the “biggest reduction in business taxes in recent British history”.

The stock prices of National Grid and SSE rose to their highest levels in four months after Hunt announced his proposal. SSE’s stock price increased by almost 1% to 1,806p per share, while National Grid’s stock price rose by nearly 0.5% to 1,043p per share.

In its decision to proceed with the construction of the world’s largest offshore wind farm near the Yorkshire coast, Ørsted, a company based in Denmark, may be swayed by potential tax benefits.

The decision to move forward with the Hornsea 3 project is uncertain due to a sudden increase in costs for the offshore wind supply chain. This development caused Ørsted to cancel two significant offshore wind projects along the US coast. A final determination on the project is anticipated before the year’s end.

The March budget is expected to see a larger increase in unemployment than initially predicted.

According to the Office for Budget Responsibility’s main prediction, the number of unemployed individuals will increase to 1.6 million, which is equal to 4.6% of the labor force, and will reach its highest point in the second quarter of 2025.

The peak in March was 85,000 higher than the expected value of 4.4%. This is one year later than originally predicted.

According to the OBR, there will be a decrease in the demand for labor as a result of slower economic growth and an increase in interest rates.

The unemployment rate is expected to decrease to its estimated structural rate of 4.1% in the predicted timeframe, due to a decrease in the bank rate and an increase in economic capacity, according to the OBR.

Source: theguardian.com