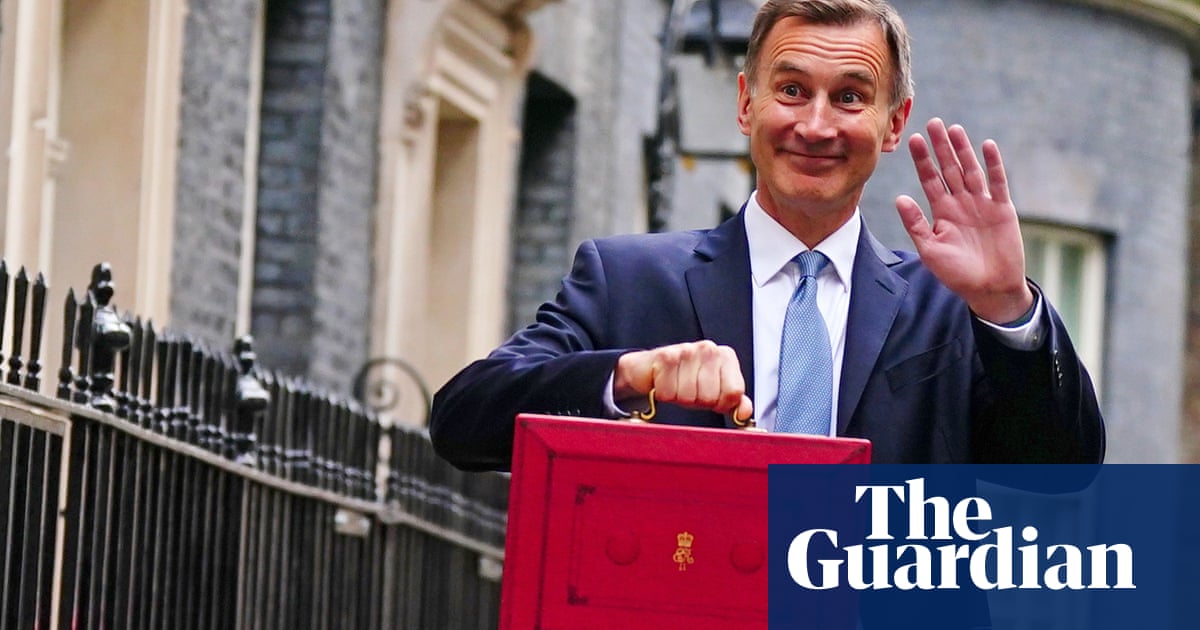

According to reports, Jeremy Hunt is contemplating getting rid of the non-domiciled tax rules in the upcoming budget for Britain. This decision would involve taking on one of Labour’s major fiscal policies.

The choice is believed to be included in a list of potential sources of income created for the chancellor and Rishi Sunak due to lower economic forecasts, which have resulted in less funds available for tax reductions or financial promises.

The Conservatives may potentially announce a policy in next week’s budget that mirrors one previously criticized by Hunt from the Labour party.

Eliminating the non-dom tax system would generate approximately £3.6 billion annually.

Treasury officials informed multiple newspapers on Wednesday that Hunt was considering eliminating or reducing the tax exemption as one of several last-minute choices in case official predictions worsened in the coming days and continued to hinder the likelihood of budgetary tax reductions. A representative from the Treasury stated, “We do not disclose information on budget forecasts prior to a fiscal event.”

In the fiscal year of 2022, HM Revenue and Customs reported a total of 68,800 individuals without permanent residence status in the UK.

As per the current regulations, individuals living in Britain who are not originally from the country can make profits from overseas investments without being taxed in the UK for a maximum of 15 years, as long as they do not transfer any earnings or gains back into the country. This loophole has been exploited by Sunak’s spouse, Akshata Murty, to avoid paying a significant amount of UK taxes.

Last month, The Guardian stated that the Labour party’s proposal to eliminate non-domiciled tax advantages would include a four-year grace period for current status holders.

In 2022, Labour announced plans to eliminate tax breaks, citing research indicating a potential increase of at least £3bn annually. Rachel Reeves, the shadow chancellor, stated that fully eliminating the tax break would generate the same amount every year, and that Labour intends to allocate the funds towards expanding the NHS workforce.

One proposal being discussed by the party is the implementation of new rules for temporary residents. One potential option is to allow individuals to reside in the UK for up to four years without having to pay full UK taxes.

In November, the chancellor stated that he was uncertain about the potential amount of revenue that would be generated by eliminating the tax status.

Hunt stated that he preferred for the extremely wealthy individuals to remain in the country and contribute to the economy. He was informed by Treasury representatives that there was uncertainty surrounding the potential financial impact of the decision.

Source: theguardian.com