The founder of a music company that holds the rights to songs by Blondie and Justin Bieber has accused his former business partner of using the proceeds of fraud to fund their collapsed venture, court documents show.

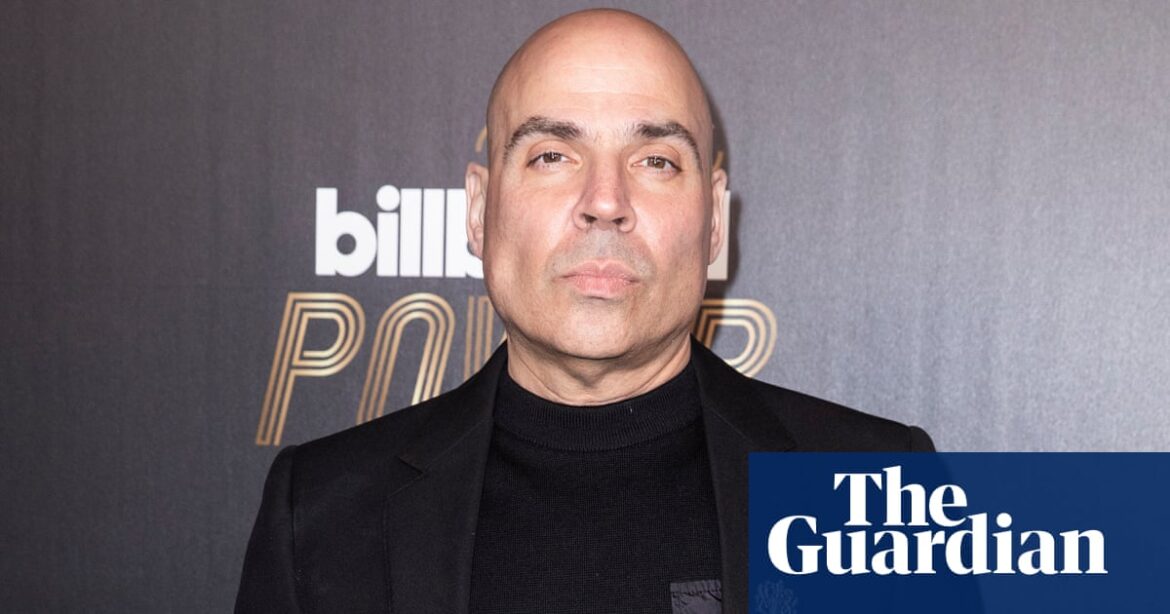

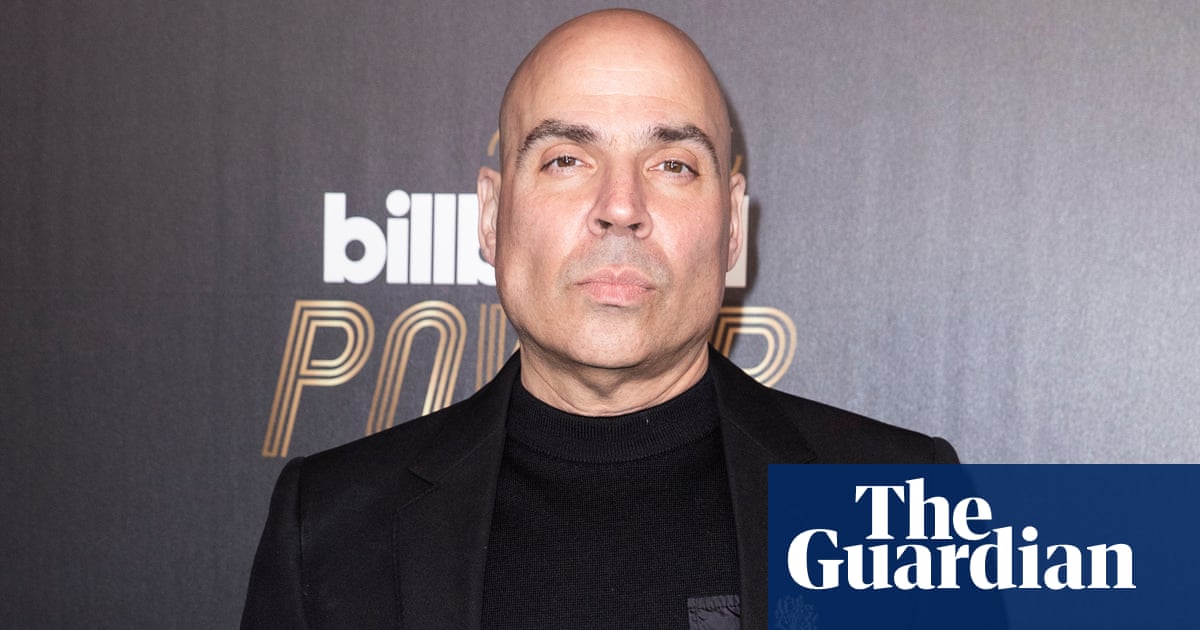

Merck Mercuriadis is the founder of Hipgnosis Songs Fund (HSF), a FTSE 250 company that buys music rights in the hope of profiting from streaming revenues, and which is now set to be taken over by private equity investor Blackstone in a £1.3bn deal.

However, that company is not Mercuriadis’s first attempt to buy up music streaming rights – or the first time he has used the Hipgnosis name. His co-founders of the now dissolved business, Hipgnosis Music Limited (HML), have brought a £200m legal action in the high court in London, claiming that Mercuriadis stole the idea from them and made millions listing it on the London stock exchange in 2018.

Mercuriadis said the claim was “as opportunistic as it is unmeritorious”, in a filing detailing his defence against the claim. He has alleged that finance for the first Hipgnosis came from a complex fraud against Swedish pension funds, of which he was unaware.

The claim also names HSF and its investment adviser as defendants. Both are also defending the claim.

The idea behind Hipgnosis was to buy up rights to music from famous artists and writers that would continue to be streamed for years. The company could pay out dividends to investors, while musicians would be happy to sell the rights in exchange for a big upfront payment rather than waiting for listeners over the course of years.

Mercuriadis is a former manager of acts including Elton John, Iron Maiden, Guns N’ Roses and Beyoncé. He appears to have held a long affinity for the word Hipgnosis, which was first the name of a graphic design group that produced album covers for the likes of Led Zeppelin, Pink Floyd and Paul McCartney. Mercuriadis set up a personal services company in 2009, with the blessing of the design group’s founder – who also sold him an upside down elephant logo that is still in use.

The listed Hipgnosis venture has been in turmoil for months after rising interest rates and concerns that it had overpaid for rights prompted investors last year to vote against it continuing. That led to a bidding war between Blackstone and a rival, Concord Music.

However, the listed company’s tumultuous time in the spotlight of the London stock market does not match that of Mercuriadis’s first effort.

At a 2014 meeting in Los Angeles, the heart of the US showbiz industry, Mercuriadis shared the rights buyout idea with his then friends, producer Aeon Manahan and Swedish musician manager Afram Gergeo.

Mercuriadis would bring his music industry contacts and nous – which he clearly valued. In his defence, Mercuriadis’s lawyers wrote: “At the time of meeting, Mr Mercuriadis had significantly greater experience – and had achieved significantly greater success – in the music industry than both Mr Manahan and Mr Gergeo.”

In return, Gergeo and another businessman, Emil Ingmanson, would bring financing through an investment fund they had set up. However, Mercuriadis “did not know – but he now understands – that the finance proposed for the new business was likely to be the proceeds of crime”, the filing alleged.

He said he first learned of concerns about Ingmanson in October 2016, when a friend informed him of media reports about the growing Swedish pension fund scandal. It was only in March 2017 that he himself searched online and found that Ingmanson and Gergeo were under investigation by Swedish authorities, the filing said.

Gergeo and Ingmanson were arrested in England in December 2017. Ingmanson went on the run before being arrested in Hungary and extradited to Sweden. He was sentenced to six years and nine months in prison in 2020. Gergeo was sentenced to nine months for “money laundering and fraud offences” in March 2021, according to the filing.

The claim against Mercuriadis said he took a “maturing business opportunity” and transferred it to a new company. However, Mercuriadis alleged that the arrests and convictions “irretrievably doomed” the original Hipgnosis’s business prospects, making it impossible to raise funds to buy song rights.

after newsletter promotion

By the time it was dissolved, HML had started negotiations with only two artists. It reached a £11.6m deal with Wayne Hector, a songwriter for Nicki Minaj, One Direction and Westlife, among others, but failed to find the money and lost out to a rival. It also started negotiations with the Isley Brothers, an American group who first rose to prominence in the 1950s with their single Shout.

HML alleged that it had also agreed a deal for consultancy services with Nile Rodgers, the Chic guitarist and a close friend of Mercuriadis, and Terius Nash, the songwriter known as The-Dream, whose hits include Rihanna’s Umbrella and Beyoncé’s Partition. However, Mercuriadis claimed that those agreements were either not completed or not binding.

A lawyer for HML said the company was “very confident” in its case, and its position was that there was “compelling evidence that Mr Mercuriadis dishonestly diverted the music catalogues business opportunity”. The lawyer added: “The key components of Mr Mercuriadis’ defence are materially inaccurate and/or irrelevant and designed to divert attention away from his own unlawful conduct.”

HML’s representatives also claimed that “there is compelling evidence that Mr Mercuriadis was aware that Mr Gergeo was under investigation and saw this as no bar to the business succeeding”.

A response to the defence is due at the end of this month, but the case may not come to trial for a year or more.

Mercuriadis, HSF and its investment adviser declined to comment.

Source: theguardian.com