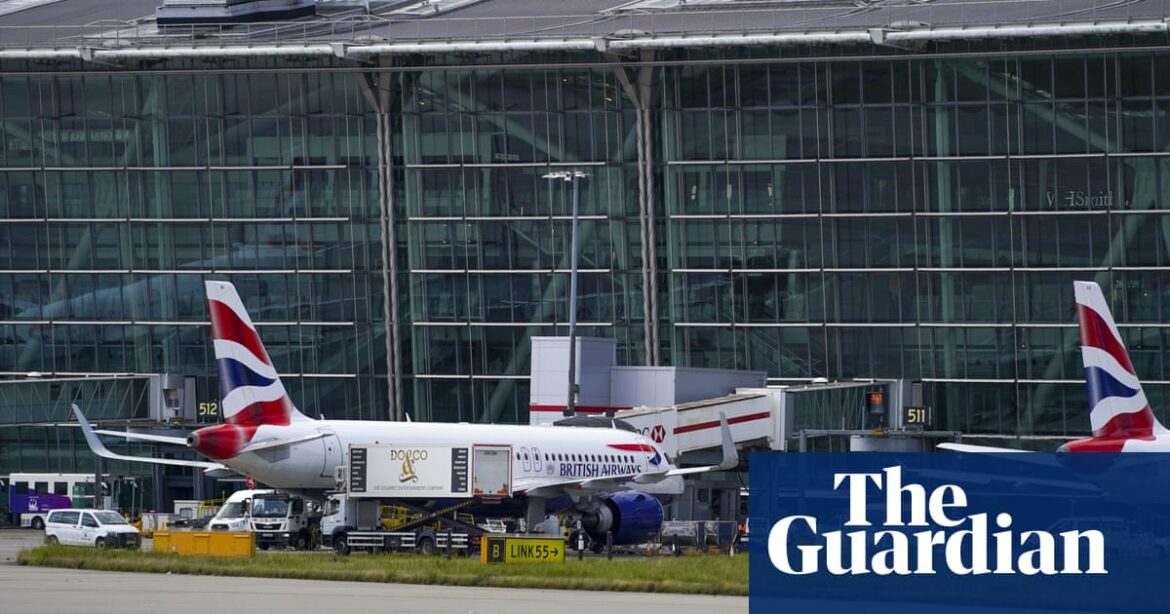

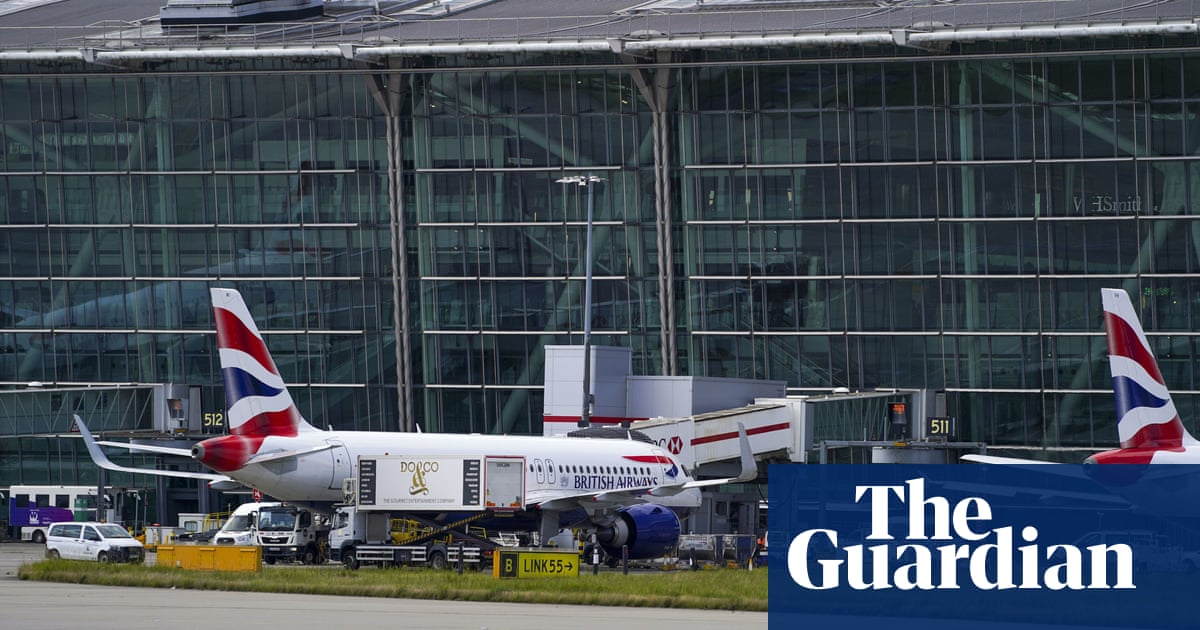

Campaigners have urged the chancellor to start taxing jet fuel – with a report showing that charging duty at the same rate paid by motorists would raise up to £6bn a year for the public finances.

An analysis by the thinktank Transport & Environment (T&E) UK said introducing a “fair” equivalent to the fuel duty paid in other sectors could raise between £400m and £5.9bn a year, based on the 11m tonnes of kerosene consumed by planes taking off from the UK in 2023.

T&E UK said the current system meant a teacher driving to school would pay more fuel duty than a private jet owner would to fly away on holiday. Airlines pay no tax on fuel, although other taxes on flights, including air passenger duty, are levied in the UK.

The report said it was a “common myth” that aviation fuel could not be taxed, with the UK having the right to tax domestic flights and, post-Brexit, flights to the EU. These account for 80% of departures. Securing the full revenues would require an “anti-tankering” law to ensure airlines bought 90% of the fuel for outbounds flight in the UK.

Fuel duty on diesel or petrol at the pumps is levied at 52.95p a litre, and many expect Labour to raise the level by scrapping the 5p cut made by the Conservatives in 2022. A lower rate of 11p is paid by farmers and rail operators for red diesel.

T&E UK called on the chancellor to apply fuel duty to every flight legally possible and said it should be introduced at a starting rate of 9p a litre next year, before rising annually until it matches road fuel duty in 2030.

The thinktank said it was not possible to say how much it would add to individual fares, but said it would probably make flights more expensive.

Its UK policy manager, Matt Finch, said: “With a £22bn black hole staring the country in the face, the chancellor needs to pursue any and all avenues to raise funds. The baffling lack of meaningful taxation of the aviation industry is a slap in the face of drivers, farmers and our ailing rail system, all of which have paid their fair share for decades.

“For the sake of the economy and the environment, it’s time to end the unfair anomaly that allows the aviation sector to pollute with impunity while not paying any [fuel] tax.”

after newsletter promotion

However, airlines said they did pay significant sums through other duties, and changes to the UK emissions trading scheme (ETS) would increase taxation.

Tim Alderslade, the chief executive of Airlines UK, said: “The aviation industry contributed £3.85bn to the exchequer last year through air passenger duty and the phasing out of UK ETS free allowances for airlines is due to raise between £1.6bn and £4.1bn between 2026 and 2033.

“The sector is fully committed to net zero emissions by 2050 and with the world’s third largest aviation network and proud history of innovation, the UK is in prime position – with government and industry working together – to lead the transition to a net zero future without hurting passengers or damaging aviation’s status as a key UK economic enabler.”

Source: theguardian.com